Cash Management for Startups: A Simple Yet Critical Strategy for Success

In the dynamic world of startups, where every day is a battle for survival and growth, managing cash efficiently is not just an administrative task — it's a strategic imperative. I wanted to write my thoughts on this fascinating space as one of the Lead Software Engineers at Mayfair, a platform looking to transform the treasury function at start-ups and small businesses. I've been thinking about why cash management is crucial for startups, the role of treasury functions, the impact of market volatility, and what the future holds in this essential domain.

Why Cash Management Is Fascinating for Startups

At first glance, cash management might seem like a dry, technical subject, reserved for the back-office tasks of large corporations. However, for startups, it represents something much more vital: the difference between thriving and merely surviving. Simple, hands-off practices in cash management can significantly extend a startup's runway, giving it the breathing room needed to innovate, pivot, and scale. In the existential dance of startup life, making every dollar count isn't just prudent—it's essential.

The Essentials of Cash Management for Startups

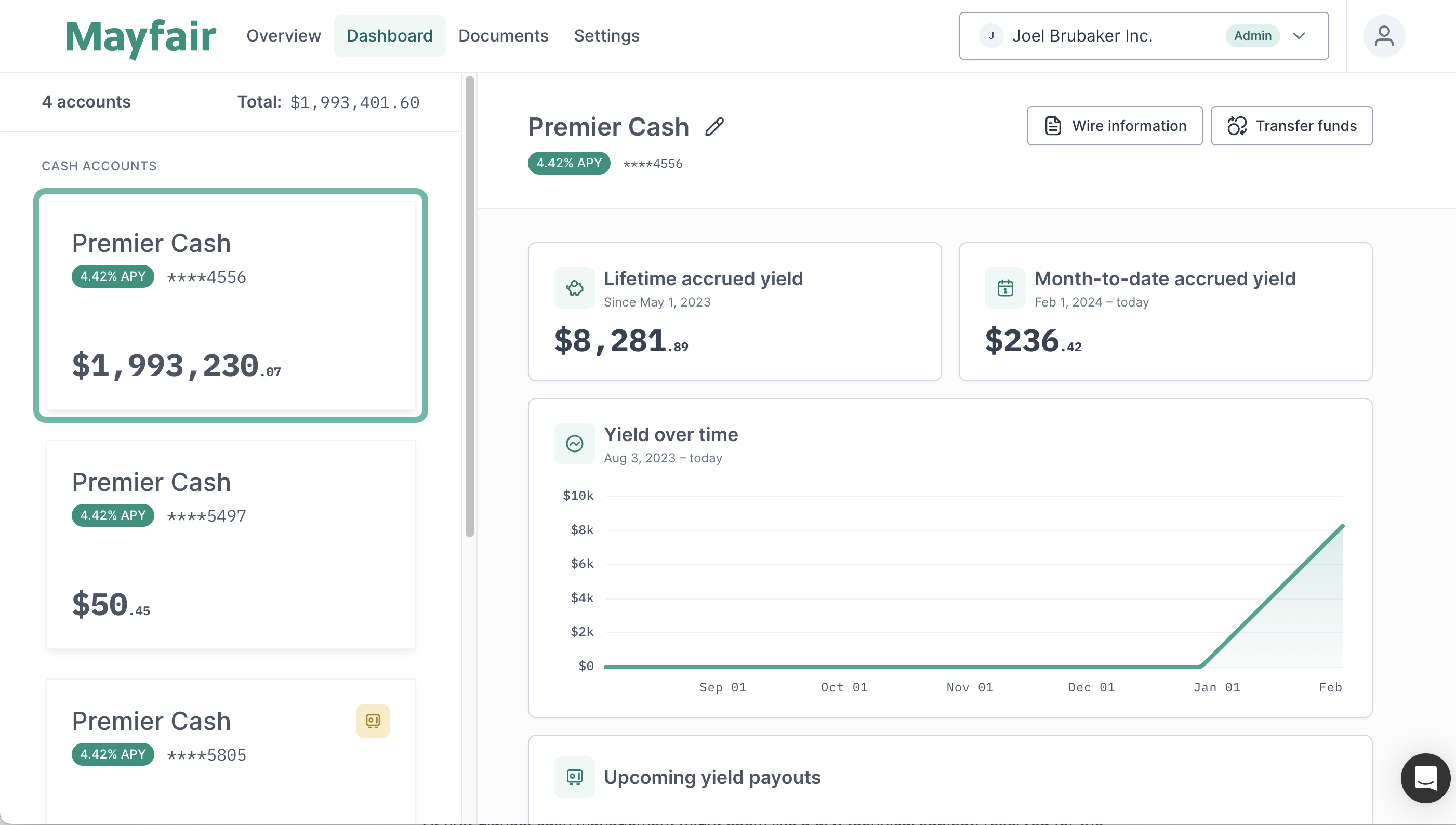

For startups, the treasury function goes beyond mere cash preservation; it's about ensuring liquidity and flexibility to navigate the unpredictable waves of early-stage business growth. Startups need cash management solutions that are not only effective but also simple to use. They require partners who understand the unique needs of small, agile companies — partners who can offer tools and accounts that keep cash flow liquid without complicating day-to-day operations. This understanding forms the cornerstone of building a financial foundation that supports rapid growth and adaptation.

Navigating Through Volatility

In just the last 12 months, market volatility has become the norm rather than the exception. For startups, this unpredictability means that having cash reserves is more than just a buffer — it's a strategic asset. Cash deposits provide startups with the flexibility needed to manage risks, seize opportunities, and maintain stability in tumultuous times. In this light, cash management practices become a critical component of a startup's risk management strategy, enabling them to weather storms and emerge stronger.

The Future of Cash Management

Looking ahead, the future of cash management for startups is likely to be shaped by ongoing market volatility and the evolving needs of dynamic businesses. The tools and strategies that startups will use to manage their cash reserves need to offer not just safety and liquidity but also adaptability. Platforms like Mayfair are poised to play a significant role in this future, offering solutions that align with the needs of startups—solutions that are simple, intuitive, and tailored to the challenges of managing cash in an uncertain world.

Leveraging Innovative Cash Management Tools

In the startup ecosystem, where every decision can tip the scales towards success or failure, effective cash management is a silent hero. It's a practice that demands attention, not just for its operational necessity but for its strategic value. As we look to the future, the importance of managing cash wisely cannot be overstated, especially in a landscape marked by uncertainty and change. For startups aiming to carve out their niche and achieve sustainable growth, embracing innovative cash management tools like Mayfair could well be the key to unlocking their full potential.